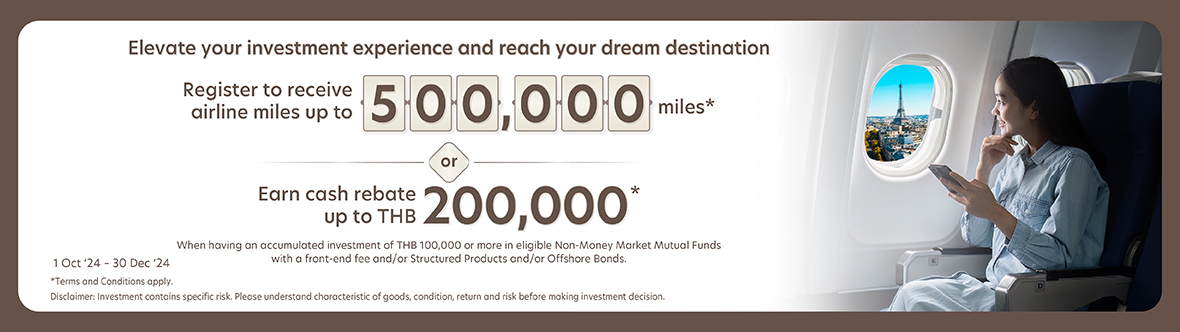

Earn cash rebate of up to THB 200,000 (or select to receive airline miles of up to 500,000 miles5) when having an accumulated invest from THB 100,000 in eligible Non-Money Market Mutual Funds with front end fee and/or Structured Products and/or Offshore Bond.

- Campaign period: 1 October 2024 – 30 December 2024

- For UOB Privilege Reserve customers, UOB Privilege Banking customers, or UOB Wealth

Banking customers or

customers who invest in eligible Non-Money Market Mutual Funds with front end fee

(not including money market

mutual funds, SSF/RMF and Thai ESG) and/or Structured Products and/or Offshore Bonds

at the total amount from

THB 100,000 within the campaign period.

Table: Cash RebateInvest in eligible Non-Money Market Mutual Funds with front end fee and/or Structured Products and/or Offshore Bond

Investment Tier

Earn Reward for investment in eligible Non-Money Market Mutual Funds and/or Structured Product and/or Offshore Bonds

Earn an Extra Reward when invest via UOB TMRW Application*

Earn On-Top Reward when invest with fresh fund

For the accumulated investment below THB 5,000,000 receive up to THB 100 cash rebate for every THB 100,000 investment*

Get THB 20 cash rebate for every THB 100,000 accumulated investment

Get THB 40 cash rebate for every THB 100,000 accumulated investment

Get THB 40 cash rebate for every THB 100,000 accumulated investment with fresh fund

For the accumulated investment exceed THB 5,000,000 receive up to THB 10,000 cash rebate for every THB 5,000,000 investment*

Get THB 2,000 cash rebate for every THB 5,000,000 accumulated investment

Get THB 4,000 cash rebate for every THB 5,000,000 accumulated investment

Get THB 4,000 cash rebate for every THB 5,000,000 accumulated investment with fresh fund

* Investment in Structured Products and/or Offshore Bonds are not applicable to earn an extra reward when invest via UOB TMRW Application.

- An eligible customer will be entitled to only the highest tier achieved per each reward type in the table above. Limit cash rebate of up to THB 200,000 per customer.

- Example of qualifying for a maximum cash rebate of THB 200,000 (valued of gifts,

rewards, or benefits offered

must not exceed 0.2% of the minimum investment amount applicable to each customer).

- Customer investing in eligible investment products at the amount of THB 100 million with fresh funds and via UOB TMRW Application. will receive THB 10,000 for every THB 5 million invested.

- Customer investing in eligible investment products at the amount of THB 170 million with existing funds via UOB TMRW Application will receive THB 6,000 for every THB 5 million invested. (a maximum cash rebate of THB 200,000)

-

In case the customer chooses to receive up to 500,000 airline miles instead of cash

rebate, customer must hold a

participating credit card before 30 December 2024. The customer will receive UOB

Rewards Points, which can be

redeemed for participating airline miles.

Type of eligible credit card

Multiplier for requesting UOB Rewards Points instead of cash rebate

The maximum UOB Rewards Points equivalent to THB 200,000 cash rebate

Airline miles valued equivalent to THB 200,000 cash rebate

Participating airlines for mile redemption will use UOB Rewards Points at the specified rate

UOB Reserved

UOB Infinite

UOB ZenithX5

1,000,000

500,000

QATAR, Royal Orchid Plus, Krisflyer, EVA, Asia Miles

UOB Privimiles

X3

600,000

500,000

Royal Orchid Plus, Asia Miles, Krisflyer

UOB ROP

UOB ROP PreferredX2.5

500,000

500,000

Royal Orchid Plus

**The conversion rate of UOB Rewards Points to airline miles is based on the rate as of 30 September 2024 and subject to the minimum mile redemption rate set by the credit card.

An Example of converting cash rebate into UOB Rewards Points at the maximum rate

- Customer can register his/her credit card in order to request UOB reward points instead of cash rebate during the campaign period between 1 October 2024 – 30 December 2024 by typing TFC(space) followed by the last 12 digit of your credit card number (no space between numbers), Send the SMS to 4545111 (Fee THB 3 per message). Customer will receive the confirmation from UOB that registration is successful.

- If the customer registers more than once, the Bank will follow the latest registration during the period of 1 October 2024 – 30 December 2024 for the reward processing.

Type of eligible credit card

Example for redeeming points from the maximum redeemable points

UOB Reserved

UOB Infinite

UOB Zenith1,000,000 Rewards Points = 500,000 miles

= THB 200,000 cash rebateUOB Privimiles

600,000 Rewards Points = 500,000 miles

= THB 200,000 cash rebateUOB ROP

UOB ROP Preferred500,000 Rewards Points = 500,000 miles

= THB 200,000 cash rebate- How to redeem rewards points for mileages, loyalty points programs, gifts, gifts cards or e-vouchers. Please visit https://go.uob.com/redeemreward

- Fresh fund refers to net amount from other source of fund outside United Overseas Bank (Thai) Public Company Limited (“the Bank”) invested during 1 October 2024 – 30 December 2024. However, fund transfers between the Bank’s accounts shall not be deemed as fresh funds.

- For existing customers, the deposit and/or investment amount that is invested on top of the customer’s balance as of 30 September 2024 must be maintained in the customer's bank account throughout the campaign period to receive additional reward when invest with fresh fund. In addition, the term "investment" in this clause also includes the balance that the customer invests during the campaign period and sells such investment unit throughout the campaign period and retains such amount of money in the customer's bank account until the end of the campaign period.

- Mutual Funds that are eligible for this campaign are Mutual Funds which have front end fee, excluding Money Market funds.

- Super Saving Fund (SSF), Retirement Mutual Fund (RMF) and Thailand ESG Fund (Thai ESG) are not applicable to this program.

- In case that customer invest in Mutual Funds and/or Structured Products and the investment amount is in foreign currency, the Bank will calculate investment amount in Thai baht from the exchange rate as of the transaction date. In case of fund switching in foreign currency, the investment value shall be calculated in Thai baht by using the exchange rate on the date of switching into the destination fund.

- The bank will credit the cashback to UOB saving account or UOB Rewards Points to the registered credit card within 60 days after the end of the campaign.

- This campaign cannot be combined with Fixed Deposit–Investment Bundle.

- Customer who participates in this program must not be a US person.

- Customer who participates in this program must perform the investment transactions with the Bank only.

- The Bank reserves its sole right to adjust, reduce or cancel any or all of the incentives under this program if the total amount of incentives to be given to the customer, either by the Bank covering all investment related campaigns, the fund houses/asset management companies, the fund managers or any other related persons, for each relevant transaction exceeds 0.2 % of the invested amount limit stipulated by the applicable laws or regulations.

- Payment of the mutual funds cannot be made with credit cards.

- For customer who also holds a joint banking account, the banking balance and monthly banking transactions, for the purpose of this promotion, will be calculated under the primary account holder of the joint account. All privileges and rewards are exclusive to the primary account holder only. The reward cannot be transferred to other persons and cannot be changed or exchanged into cash.

- The Bank reserves the right to make a final decision on any dispute arising out of or in connection with this promotion, including the right to terminate this promotion or to vary, delete, or add to any of these terms and conditions as appropriate with prior notice. The Bank's decision shall be final.

- For more information, regarding list of eligible Funds for this campaign, please contact your relationship manager.

Disclaimer: Investment contains specific risk, customer must understand characteristic of goods, condition, return and risk before making investment decision. Not an obligation of, or guaranteed by, the Bank. Not Bank deposits. Subject to investment risks, including possible loss of the principal amount invested. Subject to price fluctuation. Past performance does not guarantee future performance.